Complete List of Returned Check Reason Codes:

---------------------------------------------

Why was my check returned?

Why was the deposit returned?

What does NSF mean?

What do returned check messages mean?

Most Common Reasons For Return

- Not Sufficient Funds

- Uncollected Funds Hold

- Stop Payment

- Closed Account

- Unable to Locate Account

- Frozen Account

- Refer to Maker

- Not Authorized

- Stale Dated Check

Overview:

The U.S. Department of the Treasury publishes Check 21 Return Codes. Find out the reason codes, reasons for return, and reasons for rejection, and what the stamps and codes actually mean.

Description:

Not Sufficient Funds - Not Sufficient Funds, NSF, Insufficient Funds, ISF are the same message. NSF and ISF mean that at the time the check was presented to the account holder's bank, there were not enough funds in the account to pay the check or draft.

When a check is returned for NSF or ISF, the item can be re-deposited unless the front of the item is stamped DO NOT REDEPOSIT. Usually if an item is stamped DO NOT REDEPOSIT, the account number is also crossed out or punched out with a hole punch.

When a check is returned for NSF or ISF, the item can be re-deposited unless the front of the item is stamped DO NOT REDEPOSIT. Usually if an item is stamped DO NOT REDEPOSIT, the account number is also crossed out or punched out with a hole punch.

Uncollected Funds Hold - Uncollected Funds - UCF - UFH - UF, items are returned because funds available in the account are not yet available. This can happen when a deposit into the account holder's bank has not yet cleared.

For example, the account holder deposits a paycheck for $1,000 into his bank on Monday, and the check is set to be clear on Wednesday, making $1,000 pending, but not available. The account holder then writes a check on Monday night to a merchant that deposits the item on Tuesday. The merchant's bank presents the check on Tuesday and the bank returns the item, Uncollected Funds, because the money is there on paper, but not available.

If a check has been stamped Uncollected Funds Hold, Uncollected Funds, or a similar message, the item is eligible for redeposit. Just deposit the item again, and the hold may have been lifted.

If a check has been stamped Uncollected Funds Hold, Uncollected Funds, or a similar message, the item is eligible for redeposit. Just deposit the item again, and the hold may have been lifted.

Stop Payment - Stop Pay - Check Stop - Stop Payment Check - Stop Payment Item -

If your check or draft is returned with a Stop Payment this means the account holder, the person who originally wrote the check or authorized the draft has revoked their authorization. You cannot redeposit an item marked with a Stop Payment.

Stop Payment is a feature available to any account holder who contacts their bank BEFORE the check or draft they authorized is presented for payment. The account holder tells the bank the check number, the amount of the check and payee and the bank in turn looks for this check, or range of checks and returns the item(s) unpaid marked Stop Payment.

Closed Account - Account Closed -

When the banks stamps Account Closed or puts the Closed Account stamp on a check or draft that was deposited, this means the account holder's bank account that was associated with that check is closed. No closed account or account closed items can be re-deposited.

You must get a new check from the account holder when the item was returned Account Closed.

Unable to Locate Account - UTL - Unable to Locate - When a check or draft is returned with the Unable to Locate or UTL stamp, this means the bank cannot find any account with that account number in its records. This is most likely a check by phone or check draft where the wrong information was entered or provided.

Unable to locate checks, drafts or RCC items, may have details as to what exactly was wrong, such as a circled account number, or invalid routing number message. Some UTL or unable to locate account checks have handwritten notes on the stamp to help the merchant locate the proper details.

Unable to locate checks, drafts or RCC items, may have details as to what exactly was wrong, such as a circled account number, or invalid routing number message. Some UTL or unable to locate account checks have handwritten notes on the stamp to help the merchant locate the proper details.

Users of CheckWriter software can use RoutingTool to look up bank routing numbers and bank phone numbers. Other reasons could be the addition or absence of leading zeros in an account number, such as a customer with the account number 123456, but on the check the account number shows 000123456. Unable to locate checks cannot be re-deposited. A new item must be created or a new check would be required from the account holder.

Frozen Account - Blocked Account - Checks and drafts are returned with Frozen Account or Blocked Account messages when the bank is required to lock or Freeze an account.

This can be due to a divorce judgment, IRS tax lien, wage garnishment, court order or other legal reason that the bank can be required to freeze an account.

Checks stamped Frozen Account cannot be re-deposited - a new item is required from the account holder.

Refer to Maker - RTM - Checks returned with the RTM stamp require the depositor to contact the maker of the check. Refer to maker means, you should contact the person that wrote the check to find out why the item was returned.

If the maker does not know why the item was returned, the maker should contact their own bank for the reason. The merchant cannot obtain the reason for return from the maker's bank, only the maker can get this information. Items stamped RTM or stamped Refer to Maker cannot be re-deposited. A new item is required.

If the maker does not know why the item was returned, the maker should contact their own bank for the reason. The merchant cannot obtain the reason for return from the maker's bank, only the maker can get this information. Items stamped RTM or stamped Refer to Maker cannot be re-deposited. A new item is required.

Not Authorized - Payment Unauthorized, Not Authorized, and UA and "Counterfeit" stamps are typically a result of the account holder disputing the item during the paymentpresentment process, or if a particular block is noted on theaccount such as "nodrafts" or "no debits" and such an item is presented.

Items marked Not Authorized or Unauthorized cannot be re-deposited.

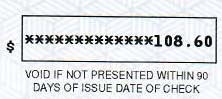

Stale Dated - Expired Check - Stale Check - Checks returned with a Stale Dated stamp are past the expiration date as set by the check issuer. Some checks are valid only if cashed or deposited within 7 days, 30 days, 90 days or 180 days. Checks with this time  limit will be returned for Stale Dated or Expired Check and cannot be re-deposited.

limit will be returned for Stale Dated or Expired Check and cannot be re-deposited.

Post Dated - Post Dated Check - If a check is returned for Post Dated this means the date on the check was for a future date. Future dated checks can be returned for Post Dated or Post Dated Check. Checks that are returned and stamped Post Dated can be redeposited on or after, but not before the date in the date blank at the top right of the check. Also check by the endorsement for wording such as "check not valid until."

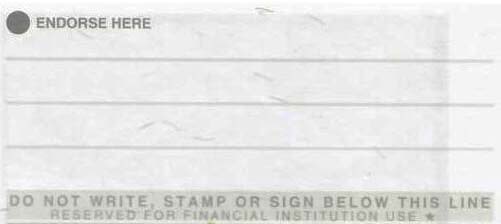

Endorsement Missing - Endorsement - If a check or check draft is returned due to endorsement missing, this is because the depositor, not the account holder that issued the check, did not endorse the item. An endorsement is a signature or stamp that goes on the back of the check. At minimum, banks require a single signature in the endorsement blank on the reverse of the check. Other endorsements include, "For Deposit Only", and "Without Recourse", and "Pay to the order of" if making a third part endorsement. You can redeposit a check with Endorsement Missing stamped on it by adding an endorsement and re-depositing the item.

Endorsement Irregular - Irregular Endorsement - Checks can be returned for irregular endorsement when there is a problem with the endorsement such as a signature mis-match, account number problem or if the endorsement cannot be read. Checks can also be returned for irregular endorsement if the endorsement goes below the like that says,

"Do not endorse or write below this line."

Signature (s) Missing - Missing signature or signature missing returns are common where the signature on a check is not present. Some checks can be returned for signature missing when two signatures are required to write a check on a particular account and only one signature appears on the check. A check with signature missing cannot be re-deposited until the signature is gathered.

Signature (s) Irregular - Irregular signature or signature irregular returns are caused by asignature that does not match the account holder, or if the signature appears damaged,altered or otherwise obscured. Signature Irregular checks cannot  be re-deposited. A new item must be obtained from the maker of the check.

be re-deposited. A new item must be obtained from the maker of the check.

Non Cash Item - NCI - A check returned stamped Non Cash Item, Not Cash Item, NCI or Not for Cash is usually an invalid check, like a rebate coupon, promotional check, or gift certificate that is deposited in error as a real check. Items stamped NCI, Not Cash Item or Non Cash Item cannot be re-deposited.

Altered Item / Fictitious Item -

Altered Item / Fictitious Item -

A check returned stamped Altered, or stamped Fictitious item does not match the account holder's records or the bank's records as far as the amount, date or terms of the check and is being returned in dispute of its validity.

This can be something as simple as someone writing a check for $125.99 and then changing the 5 in 125 to a 6 to make the check $126.50. Any alteration can void the check at the discursion of the bank. A cross out, alteration or change should be initialed by the account holder, but does not always stop returns, especially with high dollar items. This stamp,

Altered Item, or Fictitious item can also come with forged money orders, forged cashier's checks, and forged traveler's checks.

Item Exceeded Dollar Limit - Checks are returned with this stamp, Item Exceeded Dollar Limit when an account holder has a cap on the maximum daily amount the account can pass in a day, or if there is a maximum check value for the account. Checks returned with this stamp cannot be re-deposited.

What next:

If you have a check or draft returned, pay close attention to the reason code so you know if you can redeposit the item.

Protection:

Use services that will check the validity of your checks and drafts before you deposit the items. If you don't know how to contact the bank once the check is returned, call 1-900-868-2995 for the bank phone number and contact information.

Most Common Reasons For Return

- Not Sufficient Funds

- Uncollected Funds Hold

- Stop Payment

- Closed Account

- Unable to Locate Account

- Frozen Account

- Refer to Maker

- Not Authorized

RoutingTool™ Professional

- Real-Time Virtual Terminal

- Unlimited Free Transactions with No Advertising or Captcha

- API Integrates Seamlessy wth Any Platform*

- Batch File Upload or Database Download*

- *API / WebLink / Batch File Upload Average

$0.055 transaction fee - GET STARTED

$9 Setup fee

$50 Initial Deposit

------------------

$59- Total to Start

Free Virtual Terminal Account

- Real-Time Virtual Terminal

- Supported by Advertising and Protected by Captcha

- API, Batch Upload and Weblink are Inactive with Free Version

- Daily Updates - Same Results as a Paid Account.

- Unlimited Users / Unlimited Free Transactions

- No Transaction Fees

- No Monthly Fees

- Free to Sign Up

The Routing Number is a 9-digit number located between the Transit Symbols at the bottom of a valid U.S. check.

Routing Number Results are Updated Daily from the eRoutingNumber™ Database. This database includes exclusive data, not offered by other sources, like Fake Routing Numbers, and the Fraction Code or Fractional Routing Number found on the face of printed checks..

The eRoutingNumber™ database Includes All ABA Routing Numbers in the United States, as well as the bank website in many cases. The eRoutingNumber™ database also contains the bank phone number and best number to call for check verification.

The eRoutingNumber™ database uses many different sources and has evolved since 1998, and now utilizes user reporting to keep the data in check.

Any user can report a routing number missing, invalid, or provide details not included. We verify every submission and make notes or updates accordingly.

.

|

|

|

- Complete List Of Bank Participants By State:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

| - Listings shown from eRoutingNumber™ Database |

All banks are covered, not just some. Here is a list of the 50 most common banks that RoutingTool™ customers look up:

About RoutingTool™

RoutingTool™ started in 1996 as a validator script for CheckWriter™ Software, and evolved into a complete database containing every routing number in the U.S. banking system.. The validator script is still posted at the "http://yourfavorite.com" website, similarly to how it appeared then. Now, the validator script is available in the professional account so you can integrate simple validation for PHP, C#, JAVA and PYTHON. RoutingTool™ data is automatically referenced for transactions using CheckWrtier™, BetterCheck™, Text-a-Check™ and WebDebit™.

RoutingTool™ is used by 90% of the Fortune 100 Companies for 2020. Successful businesses, including banks, finance companies, fintech solutions, insurers, investors, ecommerce giants and mom and pop businesses use RoutingTool™ Virtual Terminal or RoutingTool™ Professional Accounts to verify routing numbers.

Site Navigation: Comply with Regulations.

|

eRouting Number Database |

External Links: Checks by Phone |

About Boston Commerce, Inc. - About RoutingTool RoutingTool is published by: |